Accounts Payable Automation in Healthcare: Simplifying Medical Payroll Processes

What is healthcare accounts payable automation? It comprises a sophisticated set of measures that facilitate the processing of over 90% of invoices without the need for human intervention.

A number of companies have reported that AP automation in healthcare has significantly improved their compliance, thanks to the reduction in human error. In this article, we’ll explain the basics of healthcare accounts payable automation solutions, including the implementation process, use cases, and outcomes.

| 🧾💳 Accounts payable represents a business’s debts to its suppliers, while accounts receivable denotes money owed to the business by its customers. Maintaining a balanced ratio between the two is critical for sound financial management. Healthcare entities that can benefit from automated AP processes include medical centers, hospitals, pharmaceutical companies, doctor’s offices, and medical device providers. |

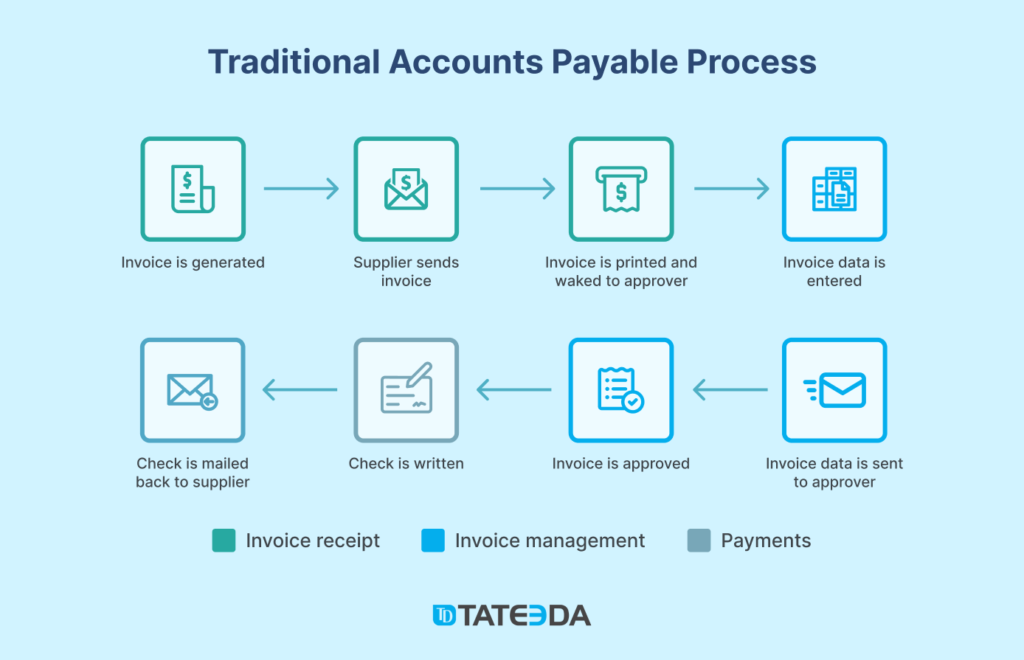

To set the stage for comprehending healthcare accounts payable automation, it’s imperative to first acquaint ourselves with the conventional Accounts Payable (AP) workflow. In the healthcare sector, this traditional process adheres to a carefully structured step-by-step manual procedure like the following:

- Invoice Generation: Healthcare providers receive invoices from suppliers for services, equipment, or supplies. Sounds simple, right? Not always. These invoices come in every shape and form—PDFs, paper copies, scanned images that look like they were faxed in from the 90s, and sometimes even handwritten notes. And yes, some of our clients have seen invoices with coffee stains on them. Every invoice needs to be reviewed to make sure the charges actually match what was delivered. Otherwise, you could end up paying for ten hospital beds when you only got five.

- Supplier Submission: Suppliers send these invoices electronically or physically to the healthcare organization. Some suppliers are on top of their game, sending invoices through secure portals or via EDI (Electronic Data Interchange). Others? Not so much. Some still rely on snail mail, meaning an invoice might take a week to arrive, and then it has to be manually logged. If it gets lost in the shuffle, good luck tracking it down.

- Invoice Reception and Review: Once the invoices arrive, the AP team reviews them and often prints out physical copies for approval. Yes, you read that right—printed copies. Even in today’s digital world, many healthcare organizations still rely on paper trails. Some desks are covered in stacks of invoices, and if one gets misplaced, it’s like looking for a needle in a haystack. This is where mistakes start creeping in—typos, missed line items, or invoices sent to the wrong department.

- Manual Data Entry: The invoice details—vendor info, amounts, payment terms—are manually entered into the financial system. And this is where things can get messy. Imagine entering hundreds of invoices every week, all by hand. One extra zero in the wrong place and—boom!—you just approved a $100,000 payment instead of $10,000. It happens more often than you’d think. Plus, let’s be honest, nobody enjoys spending their entire workday typing numbers into a system. It’s mind-numbing, and errors are inevitable.

- Data Verification: An approver within the healthcare organization reviews the invoice details to ensure everything checks out. This step is crucial, but it also introduces bottlenecks. The approver might be swamped with other work, meaning invoices sit in their inbox for days. And if there’s a mistake? Back it goes to AP for corrections. It’s like playing ping-pong with paperwork—except no one is having fun.

- Approval or Adjustment: The approver either signs off, requests adjustments, or rejects the invoice outright. Here’s where the back-and-forth really kicks in. If an invoice doesn’t match the original purchase order, someone has to investigate. Did the supplier overcharge? Was there a discount that wasn’t applied? Maybe an item was back-ordered, but the full amount was billed anyway. Sometimes, this back-and-forth can take weeks, delaying payments and frustrating everyone involved.

- Check Issuance: Once approved, the finance team generates and prints physical checks for payment. Yes, physical checks are still a thing in healthcare. Some organizations have moved to ACH transfers, but many suppliers still prefer paper checks. Why? Because they want a physical record (or they just don’t trust digital payments). Either way, this step adds more time to the process.

- Mailing Payment: Checks are mailed to suppliers, completing the payment process. At this point, you might think, “Finally, we’re done!” But not so fast. If the check gets lost in the mail or ends up at the wrong address, payments are delayed, and suppliers start calling. And let’s not even talk about how frustrating it is when a supplier claims they never received payment—only to find out the check has been sitting on someone’s desk for two weeks.

While this manual process has been the traditional approach in healthcare, it is laden with inefficiencies, potential errors, and delays. The healthcare sector in particular, with its unique requirements and regulatory demands, can benefit from modernization of AP workflows through automation.

Learn more: ➡️ Custom EMR & EHR Software Development Services

Below is an outline of the standard Accounts Payable (AP) procedures, crucial for handling the substantial volume of transactions and documents throughout the year. The procedures can be either fully or partially automated with the help of automated payment solutions in healthcare:

| Procedure | Description |

| Receiving Bills | Receipt of invoices from vendors |

| Reviewing Bills | Careful examination of received invoices |

| Updating Records | Manual updates of current financial records |

| Processing Payments | Timely initiation and processing of payments |

Looking for Healthcare Accounts Payable Automation Solutions?

Our team of 100+ seasoned engineers is ready to provide you with IT consulting and practical services for integrating AP automation with healthcare systems.

Key Features to Include in Your AP Automation Solution

Healthcare accounts payable automation systems serve as the backbone of financial operations in healthcare, biotech, and pharmaceutical organizations, quietly and effectively streamlining financial processes. These automated payment solutions in healthcare boast diverse functions, all working harmoniously to choreograph seamless and efficient accounts-payable performance:

- Invoice Processing: Envision a system adept at extracting vital medical data from invoices and emails, including supplier details, bank data, and tax IDs. It meticulously matches invoices with corresponding medical or service records, simplifying complex healthcare financial workflows.

- Approval Routing: Imagine it as a conductor guiding medical invoices through the approval process. This function ensures that invoices navigate the intricacies of healthcare hierarchies, reaching the right professionals for approval while adhering to healthcare regulations. It monitors invoice statuses and sends reminders for timely approvals.

- Payment Processing: This feature handles healthcare-specific payments, including vendor transactions, insurance reimbursements, and more. Whether issuing checks to suppliers or managing electronic payments for insurance claims, it ensures prompt, accurate financial transactions.

- Vendor Management: Imagine a dedicated assistant managing healthcare vendor relationships. It stores vendor information, tracks payment history, and provides insights for informed decision-making. Comprehensive spending reports empower healthcare administrators to optimize vendor partnerships.

- Reporting and Analytics: This function sheds light on healthcare accounts-payable processes, offering insights to optimize financial workflows. Through reports and analytics, administrators can identify cost-saving opportunities and enhance efficiency while prioritizing patient well-being.

Learn more: ➡️ AI Assistant Development Services

Here’s an even more detailed table of specific benefits of AP automation for medical centers, hospitals, pharma businesses, biotech companies, and other healthcare-related organizations existing out there…

| Stage | Common Issues | Automated Payment Solution Features |

|---|---|---|

| Invoice Generation | Invoices come in various formats (PDFs, paper, scanned images), increasing processing time and errors. | OCR (Optical Character Recognition) and AI-driven data extraction automatically scan and categorize invoices, reducing errors and improving speed. |

| Supplier Submission | Suppliers use inconsistent submission methods (email, portals, mail), leading to lost or delayed invoices. | EDI (Electronic Data Interchange) and centralized supplier portals ensure consistent submission methods and prevent lost invoices. |

| Invoice Reception and Review | Invoices are printed and manually sorted, creating inefficiencies and potential misplacement. | Cloud-based document management systems with AI-powered sorting eliminate the need for printing and manual review, streamlining hospital financial workflows. |

| Manual Data Entry | Manual entry increases the risk of data errors and slows down the workflow. | Automated invoice capture with RPA (Robotic Process Automation) pre-fills data fields, drastically reducing human input errors. |

| Data Verification | Approval bottlenecks delay payments, especially when approvers are overwhelmed. | AI-powered approval workflows send invoices to the right approver based on predefined rules, improving compliance with AP automation. |

| Approval or Adjustment | Invoice mismatches with purchase orders cause prolonged back-and-forth communications. | Machine learning algorithms match invoices to purchase orders and flag discrepancies in real time, minimizing manual intervention. |

| Check Issuance | Some suppliers still rely on physical checks, leading to delays in processing. | Automated payment processing (ACH, wire transfers, virtual credit cards) reduces reliance on physical checks and speeds up vendor payments. |

| Mailing Payment | Mailing checks is slow and unreliable, increasing the risk of lost or misplaced payments. | Digital payment tracking and automated confirmation emails ensure suppliers receive payments on time, reducing disputes and inefficiencies. |

You can now copy and use it as needed! Let me know if you’d like any modifications.

Armed with this information, organizations can pinpoint areas ripe for cost reduction and efficiency improvement. But wait, there are more features! Accounts-payable automation systems often come with additional features that elevate their capabilities:

- Optical Character Recognition (OCR): A technological method that extracts data from paper invoices (scans or PDFs) with the precision of a surgeon’s scalpel, saving time and reducing errors.

- Machine Learning: A savvy companion that uses algorithms to detect and flag suspicious invoices, adding an extra layer of security.

- Integration with Other Systems: Seamlessly connects with enterprise resource planning (ERP) and financial management systems, ensuring harmonious synergy across all financial operations.

It’s important to note that the specific functions offered may vary depending on the vendor and the unique needs of each healthcare organization. However, the overarching goal remains constant: to empower healthcare organizations to automate their accounts payable processes and elevate their financial operations to new heights of efficiency and effectiveness.

Optimizing Patient Payments with AP Automation Portal

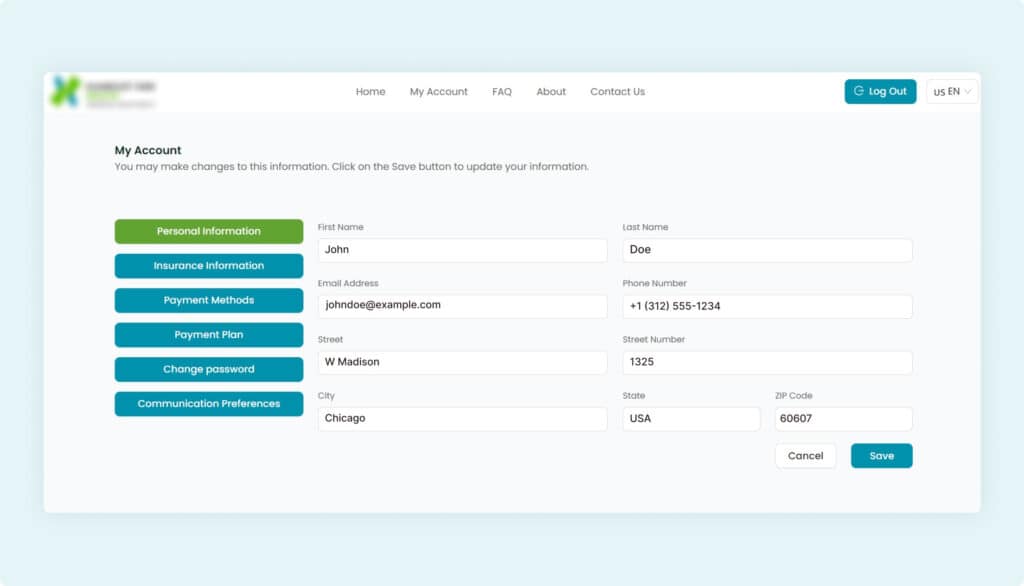

TATEEDA partnered with a U.S.-based medical provider to develop a secure, web-based Patient Payment Portal, demonstrating the power of automated payment solutions in healthcare.

Built with HIPAA-compliant custom Angular development, a .NET backend architecture for healthcare, SQL Server deployment, and Stripe payment system integration, the system streamlined patient billing by offering customizable payment plans, multiple payment methods, and 24/7 access to protected billing data.

By implementing AP automation in hospitals, solutions like this enhance payment processing efficiency while improving compliance with AP automation standards in the United States, including HIPAA, PCI, and NACHA.

The result? A more secure, automated payment system that simplified financial workflows for both patients and providers while driving cost savings with advanced healthcare AP automation.

Results of integrating AP automation with healthcare systems:

✔ 30% reduction in unsuccessful payment attempts

✔ 40% fewer support requests related to payment issues

✔ 50% faster transaction processing times

Interested in implementing healthcare accounts payable automation solutions?

| TATEEDA can be your healthcare IT partner in the creation or adoption of a system for healthcare accounts-payable automation. Alternatively, we can offer our qualified resources through a staff augmentation (outstaffing) model for third-party projects in the realm of AP automation. Please feel free to contact our representatives for further information: |

Are You Interested in Improving Compliance with AP Automation?

Our team of 100+ senior developers offers experienced specialists in automated payment solutions in healthcare.

Table of Contents

The Benefits of Accounts Payable Automation in Healthcare

What does accounts-payable automation in the healthcare industry entail?

There are various approaches to automated payment solutions in healthcare. For instance, it can involve a shared electronic transaction hub connecting healthcare organizations and suppliers. In this setup, invoices are submitted to an invoicing platform, and the buyer effortlessly captures the data.

The platform manages processing and approval, ensuring a smooth workflow that aligns with industry standards and compliance requirements. Ultimately, payments are sent securely to suppliers.

The entire process is illustrated in the chart below:

In the realm of healthcare, Accounts Payable (AP) management encounters a set of distinctive hurdles that underline the pressing need for AP automation. These challenges include:

- High invoice volume leads to inefficiencies in manual processing

- Slow approval cycles delay payments and disrupt cash flow

- Human errors cause data entry mistakes and duplicate payments

- Compliance risks make meeting HIPAA, PCI DSS, and NACHA standards challenging

- Fraud vulnerabilities increase the risk of unauthorized transactions

- Manual payment processing consumes time and resources

- Lack of real-time tracking limits visibility into payment status

- Disjointed systems create integration challenges with financial software

- Supplier disputes arise due to invoice errors and payment discrepancies

- High operational costs result from excessive manual processing.

Learn more: ➡️ Custom Healthcare Billing Software Development Services

Simplified Payment Terms and Arrangements

Every supplier contract comes with different rules—payment schedules, early-payment discounts, late fees. Tracking all of that manually is a recipe for confusion. Healthcare accounts payable automation simplifies things by standardizing payment terms, ensuring invoices are processed on time, and preventing costly delays. The biggest win? Automated approvals and contract-matching free up finance teams to focus on vendor relationships instead of chasing down signatures and correcting errors.

Streamlined Invoicing

If there’s one thing that slows down payments, it’s dealing with invoices manually. One of the biggest challenges in manual accounts payable processes is lost paperwork, delayed approvals, and human errors that lead to incorrect payments. Automated payment solutions in healthcare eliminate these roadblocks by digitizing invoices, matching them with purchase orders, and automatically routing them for approval. No more stacks of paper, no more endless back-and-forths—just faster payments, fewer errors, and happy vendors.

Fraud Prevention and Control

Paper-based AP processes open the door to fraud—duplicate invoices, unauthorized transactions, and financial inconsistencies that slip through unnoticed. Automated payment solutions in healthcare help shut those risks down with AI-managed fraud detection, automated audit trails, and strict role-based access controls. If something looks off, the system flags it immediately—before it becomes a costly mistake.

Enhanced Regulatory Compliance

Healthcare finance teams deal with strict regulations like HIPAA, PCI DSS, and NACHA, all while ensuring patient and financial data stays secure. AP automation makes this easier by encrypting sensitive data with AES-256, securing transactions with TLS 1.2, and maintaining a clear, auditable record of every payment. That means no last-minute compliance scrambles, fewer regulatory headaches, and a finance system built for security and accountability.

Optimized Resource Utilization

AP teams in healthcare already have enough to manage—vendor relationships, billing, compliance, and beyond. Streamlining hospital financial workflows with healthcare AP automation takes repetitive tasks off their plate, eliminating manual invoice approvals and slow payment processing. With intelligent routing and AI-powered verification, finance teams can finally shift focus to strategic planning instead of being buried in administrative work.

Precision and Error Reduction

AP mistakes don’t just cause delays—they lead to major financial waste. Incorrect payments, duplicate transactions, and reconciliation errors create unnecessary costs. Best practices for automating medical payments include AI-driven validation tools that instantly catch inconsistencies, auto-correct minor entry errors, and reconcile financial records in real time. The result? A more accurate, more reliable, and far less frustrating AP process.

Financial Efficiency and Savings

Reducing unnecessary costs is a major priority for any healthcare organization. One of the biggest benefits of cost savings with healthcare AP automation is cutting down on manual processing costs, eliminating late fees, and ensuring organizations take full advantage of early-payment discounts.

Optimized payment schedules and predictive analytics help keep cash flow steady, ensuring long-term financial stability.

Boosted Efficiency and Time Management

Slow, manual payment processing creates unnecessary bottlenecks that slow down hospital operations. Healthcare accounts payable automation speeds things up with automated reminders, auto-populated payment fields, and real-time tracking dashboards. No more waiting on approvals, no more lost invoices—just a system that works efficiently with minimal human intervention.

Implementing an AP Automation Solution in Healthcare

Implementing accounts-payable automation in healthcare is a strategic decision that requires careful planning. Here is a step-by-step guide to help healthcare organizations successfully integrate this technology:

| Implementation stages | What’s going on? | Tools and recommendations |

|---|---|---|

| 1. Assessment: Identify Gaps and Inefficiencies | Before diving headfirst into automation, take a deep breath and assess where your processes are falling short. Understand the challenges in manual accounts payable processes—slow approvals, misplaced invoices, and compliance headaches that waste time and resources. | Visual analytics tools like Power BI or Tableau can be used to reveal data trends. Pair these with OCR tools like ABBYY FlexiCapture or Tesseract OCR to evaluate invoice formats and accuracy. If repetitive tasks are eating up your day, explore process mining with Celonis to expose hidden inefficiencies. |

| 2. Vendor Selection: Choose the Right Technology Partner | Not all vendors are created equal. Select a partner with proven expertise in accounts payable automation in healthcare who can integrate seamlessly with your existing systems and truly understand the unique demands of the healthcare industry. | Look for vendors offering pre-built integrations with major ERP systems and robust APIs for data exchange. For scalability and efficient cost savings with healthcare AP automation, consider cloud-based solutions on platforms like AWS or Microsoft Azure. |

| 3. Customization: Align the Solution with Your Workflow | Configure the healthcare accounts payable automation system to fit your operations like a glove. Focus on improving accuracy in healthcare payments by configuring the automated payment solutions in healthcare to match your unique approval processes, payment schedules, and compliance needs. | Deploy AI-driven invoice matching tools to catch discrepancies early. Set up smart approval workflows that adjust dynamically based on payment thresholds and departmental budgets, and integrate with compliance tracking tools to meet regulatory standards. |

| 4. Training: Prepare Staff for a Smooth Transition | Empower your team with the skills they need to excel in implementing AP automation in hospitals or medical centers. Incorporate best practices for automating medical payments into your training to ensure everyone is ready to make the most of the new system. | Organize interactive training sessions via LMS platforms like Moodle or SAP Litmos. Provide sandbox environments for hands-on practice and set up role-based permissions to ensure each team member gets the appropriate access and guidance. |

| 5. Testing: Validate Before Full Deployment | Rigorously test the healthcare accounts payable automation system before going live. Ensure everything works flawlessly by identifying and fixing issues in a controlled environment, so you can avoid surprises later. | Use automated testing tools like Selenium for UI validation, JMeter for performance testing, and Postman for API validation. Conduct stress tests to confirm the system can handle high volumes and prepare rollback plans in case of unforeseen failures. |

| 6. Rollout: Implement in Phases for a Controlled Transition | Ease into the new system gradually to minimize disruptions and keep improving compliance with AP automation. A phased rollout lets you fine-tune the process while still supporting legacy systems, ensuring a smooth switch to your new automated payment solutions in healthcare. | Start with a pilot program in a low-risk department, then scale up as you monitor key metrics. Leverage AI-powered analytics in IBM Cognos or Google Looker to track improvements and witness the cost savings with healthcare AP automation as your process becomes more efficient. |

Best Practices for Automating Medical Payments

| Best Practice | Description |

|---|---|

| Standardized workflows | Ensures consistency in invoice processing and approvals. |

| AI-powered data extraction | Reduces manual entry errors and speeds up processing. |

| Automated approval routing | Accelerates decision-making and eliminates bottlenecks. |

| Real-time payment tracking | Enhances visibility and prevents delays. |

| Seamless integration | Ensures smooth operations with existing financial systems. |

| Multi-layered security features | Protects against fraud and unauthorized transactions. |

| Compliance enforcement tools | Helps meet HIPAA, PCI DSS, and NACHA requirements. |

| Predictive analytics | Optimizes cash flow management and financial planning. |

| Electronic payment methods | Eliminates reliance on paper checks and manual processing. |

| Regular system audits and updates | Ensures continuous improvement and efficiency. |

If you desire our assistance and consulting for the successful implementation of accounts-payable automation in the healthcare industry, please do not hesitate to contact us today:

Custom Healthcare Solutions

See how we can engineer healthcare software, validate your ideas, and manage project costs for you.

Potential Challenges in Implementing Healthcare Accounts Payable Automation Solutions

While the benefits are substantial, healthcare organizations may encounter challenges during the implementation of accounts-payable automation. Common obstacles include resistance to change, integration with existing IT systems, and ensuring data security. Tackling these challenges takes solid planning and clear communication, but once that’s in place, the benefits of streamlining hospital financial workflows—like ongoing resource savings and fewer errors—start to add up fast

To exemplify the tangible benefits of accounts-payable automation in healthcare, we’ll delve into scenarios from organizations that have embraced this technology. We’ll explore two hypothetical situations of AP automation in the healthcare sector:

Scenario 1: Pioneering Biotech Ventures

Imagine a forward-thinking biotech enterprise deeply immersed in groundbreaking research and development endeavors. This innovative biotech entity collaborates extensively with research institutes on a global scale, sourcing an extensive spectrum of supplies such as laboratory equipment, specialized chemicals, and genetic materials.

These resources hail from a diverse array of global suppliers, each adhering to distinct invoicing formats, currencies, and payment conditions. The arduous task of managing this mosaic of invoices manually can swiftly burgeon into a logistical challenge replete with error-prone processes and operational inefficiencies.

In this scenario, the implementation of AP automation not only streamlines the invoicing process but also enhances procurement efficiency. By automating data extraction, matching, and processing, a biotech company can allocate more time and resources to research and development, thereby accelerating their groundbreaking work.

Learn more: AI in Biotech Software Development

Scenario 2: Innovative Pharma Solutions

Now envision a dynamic pharmaceutical powerhouse celebrated for its pioneering strides in drug development. This distinguished pharmaceutical entity, renowned for its innovation, collaborates with a global network of suppliers sprawled across multiple continents.

It acquires a spectrum of vital resources encompassing pharmaceutical elements, research data, and cutting-edge manufacturing equipment. These widely dispersed suppliers often introduce distinctive invoicing structures, currencies, and payment terms into the mix. Manual processing of this multifaceted range of invoices can rapidly morph into a complex endeavor fraught with the potential for error and operational bottlenecks.

In this scenario, AP automation not only simplifies invoice management, but also contributes to better financial visibility. By automating the complex processing of diverse invoices, this company gains greater insight into its financial operations. This enables them to make more informed decisions, optimize their supply chain, and ensure the timely delivery of innovative pharmaceutical products to market.

Building the Right Custom Accounts Payable Automation Solution

Step 1: Assess Your Needs

Begin by conducting a comprehensive assessment of your healthcare organization’s specific needs and requirements in accounts-payable automation. Identify key factors such as scalability, integration capabilities, and vendor support, which are all crucial to the success of this initiative.

Is integrating AP automation with healthcare systems too complex? It doesn’t have to be. The key is understanding your existing infrastructure before implementing automation. Does your system need AI-driven invoice processing, OCR for digitizing documents, or HL7/FHIR compatibility and API integration with EHR/ERP platforms like Epic or Oracle Cerner?

Start by mapping your current system architecture with tools like Microsoft Visio or Enterprise Architect. Check API readiness with Postman to ensure smooth data exchange. Follow best practices for automating medical payments, including AES-256 encryption and TLS 1.2 for secure transactions, ensuring compliance with HIPAA and PCI DSS. Get automation right from the start—without the headaches.

Step 2: Research Potential Solutions

Explore the landscape of healthcare accounts-payable automation solutions available in the market. Look for options that align with the factors identified in the assessment phase.

AP automation in hospitals isn’t just about moving payments from point A to point B. When streamlining hospital financial workflows, the right AP automation solution needs to do more than just process payments—it should keep transactions secure, compliant, and effortlessly integrated into your existing systems. Look for real-time payment tracking, automated reconciliation, and built-in HIPAA and PCI DSS compliance to handle financial transactions without risk.

— Andrew G., Senior Software Engineer at TATEEDA

Dig deeper into the tech side. AES-256 and RSA encryption protect sensitive payment data, while cloud-based deployment on AWS or Azure (or on-premise with VMware) ensures scalability. Stripe payment system integration brings automated patient invoicing practices, like recurring billing, and secure transaction processing, reducing manual effort at every step.

Use MuleSoft or Dell Boomi to connect legacy financial systems with modern AP automation, making compliance easier and payment flows faster. The right setup doesn’t just automate—it transforms how payments move through your healthcare system.

Step 3: Evaluate an IT Partner

Consider TATEEDA, a seasoned expert in healthcare software development, as your potential partner. Assess our expertise, experience, and the suitability of our solutions to your organization’s needs.

Before selecting your potential health IT partner, analyze their technical capabilities by reviewing the following:

- Skills in development frameworks such as .NET Core or Java Spring Boot.

- Security architectures may incorporate tools like Splunk for SIEM and log management.

- Integration practices for international online payment platforms like Stripe.

- Track record with integrations using healthcare standards like HL7 and FHIR for secure data exchange.

Step 4: Collaborative Consultation

Engage in a collaborative consultation with TATEEDA or any other tech partner of your choice to discuss your specific requirements and objectives. Evaluate how a potential accounts payable automation solution can be customized and configured to meet your unique needs .

This collaborative process for healthcare accounts payable automation will involve technical workshops that use system mapping tools like Lucidchart, interface design applications such as Figma, Adobe XD, or Sketch, and API development platforms like Swagger or Postman. At the same time, the entire process must be perfectly aligned with healthcare IT standards, including HL7, FHIR, and DICOM for medical imaging.

Step 5: Solution Customization

Work with TATEEDA to customize your chosen accounts-payable automation solution to align perfectly with your healthcare organization’s requirements.

Customization may involve developing bespoke modules in programming languages like Python or JavaScript, configuring advanced integration points with third-party systems such as SAP or Oracle ERP, and setting up real-time analytics dashboards using tools like Tableau or Power BI to deliver detailed insights into transaction processing and system performance.

Step 6: Implementation

Initiate the healthcare accounts payable automation implementation process of your customized solution under TATEEDA’s or another partner’s guidance, which ensures organic integration into your existing healthcare infrastructure and includes improving accuracy in healthcare payments.

Our healthcare accounts payable automation strategy encompasses comprehensive QA testing phases—from unit and integration tests using frameworks like JUnit or Selenium, to full-scale user acceptance testing supported by continuous integration tools such as Jenkins or GitLab CI, along with performance testing via JMeter or LoadRunner to guarantee data integrity and smooth system interfacing.

Step 7: Training and Adoption

Train your healthcare team to effectively use the new accounts-payable automation solution and ensure a smooth transition away from manual processes.

In addition to standard training sessions hosted on platforms like Microsoft Teams or Zoom, we offer hands-on workshops, provide detailed technical documentation via Confluence or SharePoint, and set up sandbox environments using Docker containers or VMware virtual machines to replicate real-world scenarios for effective learning and troubleshooting of ntegrating AP automation with healthcare systems.

Step 8: Ongoing Support

The benefit of AP automation for medical centers is offered by TATEEDA’s ongoing health-tech support and maintenance services to address any issues and evolving needs as your healthcare organization continues to grow.

Our support framework encompasses 24/7 monitoring with tools like Nagios or Datadog, proactive system updates deployed through AWS CodeDeploy or Azure DevOps, and iterative software patches using configuration management solutions like Ansible or Puppet, ensuring the solution remains secure, compliant, and optimized for the peak performance of automated payment solutions in healthcare.

Step 9: Monitor and Optimize

Regularly monitor the performance of the accounts-payable automation solution, identify areas for improvement, and optimize use to maximize efficiency and effectiveness.

Use advanced monitoring tools such as Grafana or Kibana to create real-time dashboards, set up alerting and log analysis with Splunk, and conduct periodic system audits using compliance tools like Nessus or Qualys, enabling continuous improvements in system performance and operational resilience for improving compliance with AP automation in the long run.

Do you require assistance with AP automation technology?

If you need assistance researching a potential AP solution for your healthcare company plus development/testing of a custom system setup and/or configuration, TATEEDA GLOBAL is here to support you. Take a look at some of our successful projects for reference:

Delivered Healthcare Software Portfolio

The leading American healthcare companies benefit from working with us.

TATEEDA as Your Potential Partner for Automated Payment Solutions in Healthcare

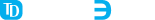

Our team of seasoned experts is dedicated to crafting customized solutions for billing and tracking automation of time and materials. Our engineers design systems that seamlessly integrate with your current platform, ensuring a smooth transition and peak performance.

With TATEEDA GLOBAL as your ally, you’ll receive the tools you need to achieve streamlined, efficient healthcare accounts-payable processes—unlocking the benefits of AP automation for medical centers and streamlining hospital financial workflows.

Our solutions not only deliver significant cost savings with healthcare AP automation but also come with robust HIPAA compliance and advanced security measures. Our offerings include:

- Protected Patient and Staff Portals: Secure mobile apps and web interfaces that offer convenient, anytime access to sensitive data.

- Efficient API-Based Integrations: Reliable, secure connections that tie together various systems within your financial workflows.

- Integration with Online Payment Solutions: Seamless connectivity with popular platforms like Stripe, providing a variety of PCI-DSS-compliant payment options.

- ERP and Inventory Management Integration: Robust connections with ERPs and inventory management systems—including partner solutions—to build a cohesive multi-system conglomerate across your organization.

- Staff Management System Integration: Comprehensive solutions for tracking work hours, managing sick leaves, vacations, credential management, and more.

- Customizations and Tailored Modules: Bespoke features such as custom reporting dashboards and specialized workflow automations that adapt perfectly to your unique operational needs.

FAQ: AP Automation Solutions for Healthcare Organizations

What is the cost of delivering custom automated payment solutions in healthcare?

On average, projects for healthcare accounts payable automation can range from about $50,000 to $150,000 and more, depending on the complexity and scope of your workflows/systems. However, the true value lies in the tremendous cost savings with healthcare AP automation that often far exceed the initial investment! Most projects integrating AP automation with healthcare systems take between 4 to 9 months, meaning you can start streamlining hospital financial workflows relatively quickly and reap the benefits of AP automation for medical centers sooner than you might think. For a more accurate estimate based on your very specific needs, please contact our representatives for a free consultation.

Is accounts-payable automation compliant with healthcare regulations like HIPAA?

Yes. Reputable accounts-payable automation solutions are designed to be compliant with healthcare regulations like HIPAA. Normally, automated payment solutions in healthcare incorporate robust security measures to protect patient data and ensure compliance with all relevant industry standards.

How do accounts-payable automation solutions integrate with existing healthcare IT systems?

Accounts-payable automation solutions can be seamlessly integrated with existing healthcare IT systems through APIs and custom development. This integration ensures the smooth and secure flow of data between systems and minimizes disruptions to your healthcare practice workflows.

Can accounts-payable automation in healthcare be scaled as the organization grows?

Absolutely. Accounts-payable automation solutions are designed to be scalable, allowing healthcare organizations to adapt and expand their automation processes as they grow. This scalability ensures that the technology continues to meet evolving needs and increasing financial transaction volume.

![Best AI Development Companies [USA] Title Image](https://tateeda.com/wp-content/uploads/2025/11/Best-AI-Development-Companies-for-the-United-States-1-2.jpg)